Nine Easy Principles to Avoid Being

Taken for a Ride When Buying a Used Car

There are few industries with the poor reputation earned by used car dealers. From the moment you step foot onto the car lot, it seems that every step in the car buying process is designed to irritate you, the customer. Of course, there are good used car dealers, but unfortunately, they are the exception. It is no wonder people hate shopping for used cars! Like a visit to the proctologist – necessary, but usually not pleasant.

Our goal is to give you tools that will give you the confidence to be an intelligent, informed consumer of used cars. This article is not so much about the product as it is about the process- a process that has been designed specifically to keep the power in the hands of the dealer. While we cannot guarantee you a flawless experience every time, following these nine easy principles should help keep the balance of power in your favor. Stick this article in your pocket and refer to it often on your quest for the right car at the right price.h3

Principle #1: Set a budget and then stick to it.

No matter your price, $2,000, $12,000, or $20,000 car, dealers will try to “up-sell” from the start. Insist that they only show you cars in your price range to prevent falling in love with a car that is outside of your budget, when you could have just as easily loved a car that is the right price for you.

Principle #2: Park your emotions at the curb.

Showing some reserve in your attitude will go a long way in motivating the dealer to make concessions in order to close the sale. If you do not, used car dealers know how to manipulate these emotions to their advantage. For example, if you think you have found the perfect car, try not to be overly enthusiastic about it. Dealers will be quick to note your enthusiasm and will proceed on the belief that you will be easily persuaded to buy the car on their terms. They will be far less likely to negotiate.

Principle #3: Limit the number of features you consider non-negotiable.

Every time you add a feature to your “must have” list, the chance of finding a good car goes down exponentially. Color is a good example— if you insist on a dark blue model, you run the risk of walking right past a much better light blue car to get your first color choice. Instead, you should focus on low mileage, general condition, and safety in the cars that will meet your needs. Consider it a bonus if you end up with a car in your favorite color with a sunroof.

Principle #4: Make the dealer put a starting price on their car.

Do not let the dealer force you into naming the price first. They often like to play games by asking disarming questions like: “What price will it take for me to get you into this car today?” This tactic is designed to get you invested in the car as quickly as possible. It also is a way to get you to commit to buying the car, while they take advantage of you in other areas (see principles to follow). It is their car— make them name the price. Then you can either walk away if the price is too far outside your price range, or you have a clear starting point in the negotiation process.

We highly recommend bringing a copy of both the Kelley Blue Book and NADA price guides with you. You should be able to purchase them for about five to ten dollars at most bookstores, or they are available online. Take a little time to learn how to use them, and you will find them to be valuable and informative tools. Do not hesitate to let the salesman see them in your hand or sticking out of your pocket. It just might bring a little sanity to their conversation with you.

Principle #5: Take the time you need to make a good decision.

Do not let the salesperson put you under pressure to decide on their timetable. It is common for a dealership to use mock urgency or a bogus sale to push you into deciding before you are ready. Be prepared to walk away if the smoke gets too thick. Remember there is always another car and another day.

Principle #6: Know how to use “Four-Square Buying” to YOUR advantage.

“Four Square Buying” is our spin on what is known in the used car business as the “Four-Square Method of Selling.” This method of selling is used by salespeople to baffle and badger you into letting your guard down in one or more of the four key decision areas: price, trade value, down payment, and loan. What often happens is they direct your focus to just one or two of these areas, and then take advantage of you in the others. In other words, they might pay you a high price for your trade in and keep your down payment low, but then stick you with a high total cost and/or a bad loan.

However, you can use the same method as a consumer to keep yourself informed in all these same areas. Use the form provided at the end of the article both before you get on the lot and while negotiating the terms of the deal. Before you begin looking at specific cars, decide what is acceptable to you in each category. Then keep track of what is being offered in each area to make sure it is in line with what you want. If you keep the form on the table during the negotiation process, there will be little room for confusion, last minute surprises, or game-playing on the part of the dealership. You might even get the salesperson to initial the agreed upon terms as you go along. Sometimes it will become clear that the salesperson you are dealing with does not have the authority to negotiate the terms of your deal. They will often leave you in the office while they go consult with their sales manager. You might ask to speak directly to this person to speed up the process and cut down on the back-and-forth nonsense.

Principle #7: Get the car inspected before making a final decision.

You will want to use your mechanic to do a full inspection. Ask to make a refundable deposit. Make sure that it is understood that a completed purchase is contingent on the car passing the inspection. Never accept the selling dealer’s report or inspection as a substitute for your own inspection. Have a shop lined up in advance. You cannot expect a dealer to hold a car for more than 24 hours. Good dealers will participate by delivering and picking up the car if your shop is nearby. Make sure that the technician who does the inspection report understands that it belongs to you, not the dealer. Be prepared to pay between $50 and $150 for this service depending on how comprehensive you wish it to be. Most shops will have a standard form and report. You will have several options depending on the results of the completed inspection. If the inspection shows major deficiencies, return the car, take your deposit, and keep looking. If some repairs are necessary, either allow the dealer to complete these repairs without charge and then have the car re-inspected, or you can have the price of the car adjusted and the repairs done by your shop. Obviously, the best result is that there are no deficiencies, and you buy the car.

An ounce of reason is necessary here. You cannot expect a used car to be perfect. If the car is otherwise in good condition, you might need to be willing to absorb the cost for small items. The inspection process and subsequent negotiation is where a little mental toughness can be an asset. Most dealers dislike this process for good reason. Most dealers do little or no mechanical reconditioning before offering a car for sale. This process will expose this and protect you. Your feet are your strongest ally. If you get resistance from the dealer about the inspection and reasonable repairs, walk out the door. There are literally thousands of cars from which to choose and you do not need to buy their car.

Principle #8: Remain in control while negotiating financing.

Most dealerships make about as much money at this stop as they do on the actual car. Do some homework before getting to this point. Check with your bank or credit union to find out what kind of interest rate you qualify for. If you have good credit, you should not have to pay any mark-up to the dealer for the loan itself. If the dealer offers Credit Union Direct Lending, there should be no fees or prepayment penalties. If you don’t like the terms, they are offering you, have them hold the car with a small deposit. Then go to your financial institution with a purchase order and have them do the financing. If you have poor credit, it is even more important to either save up and pay cash or pre-arrange a loan.

A word of caution here: in states like Washington, there is no limit on the interest rate that dealers can charge you. The dealer will often get you to agree to a monthly payment and then lengthen the term of the loan and/or raise the interest rate. You are distracted by the favorable monthly payment but grossly overpay on the other terms of the loan. This is a good time to pull out your “Four-Square Sheet” again.

Principle #9: Consider carefully what “extras” you truly need.

Don’t allow the Finance and Insurance Department to pile on needless products and charges. Some examples of these are Credit Life Insurance, Major Power Train warranties, undercoating, and fabric treatment. In most cases, you will not need any of these things, so don’t get stuck paying for them. Other unnecessary items to watch for are Document or Administrative Fees. While these are not illegal fees, they are considered “junk fees” and you should not have to pay them. A tax that is now illegal for dealers to charge you is the “Business and Occupation Tax.” They are required by law to pay this themselves.

One product you might want to consider adding is a good extended warranty or service contract. Again, avoid warranties that are limited to major power train. While they can have value to you if included in the purchase price, they are by nature very limited in scope and coverage, thus they are rarely used. A good warranty will be close to the one the manufacturer originally offered. Age of the car and its mileage will determine cost and coverage. When choosing a good warranty, the cheapest option is not always the best one. We have written an entire article on warranties that you can access at our website at http://www.keithcoxautobahn.com .

Depending on the amount of your purchase that you had to finance, the other product that you might want to take a look at is GAP insurance. If you must finance the entire car purchase in addition to the taxes, license, and warranty, you will end up owing significantly more on the car than it is worth for several years. In the unfortunate event of a total loss, GAP insurance covers this “gap” between what you owe on the car and what it is worth. Without this coverage you will personally have to make up the difference between what your insurance will pay and what you still owe. The dealer makes a profit on warranties and GAP insurance. Therefore, it is fair and prudent, to shop around and/or negotiate the price. Most service shops and lending institutions offer both products. They are also available online.

Hopefully, you will find these principles to be valuable as you navigate the used car buying experience. You do not have to be at the mercy of the dealership. Knowledge and confidence will be great assets as you remain in control during this process. There are plenty of cars out there. Following these guidelines should assist you in finding a great car at a fair price with good terms. You might even have a little fun in the process!

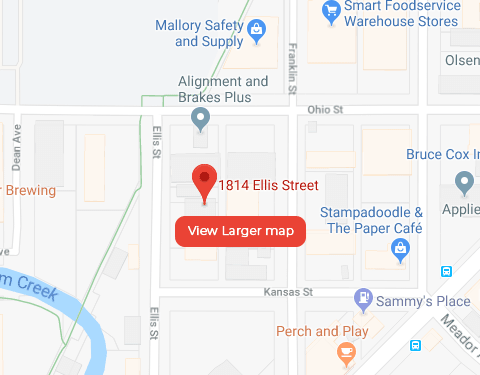

Located in Bellingham, Mint Automotive welcomes drivers from all throughout surrounding areas including: